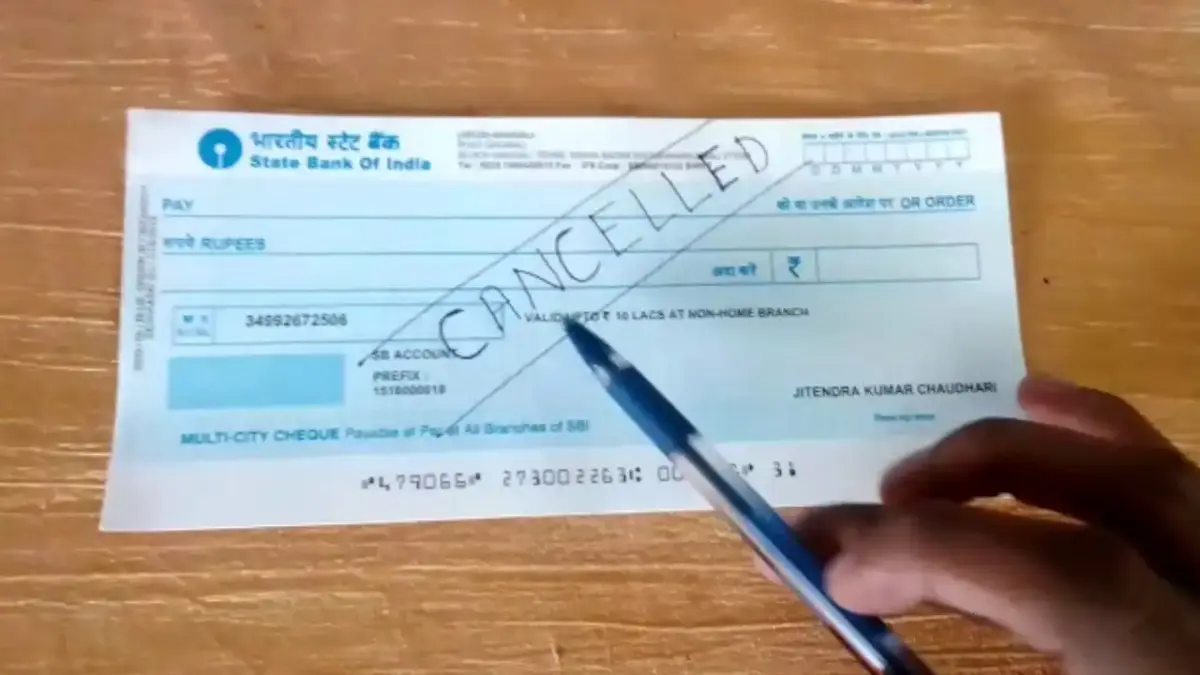

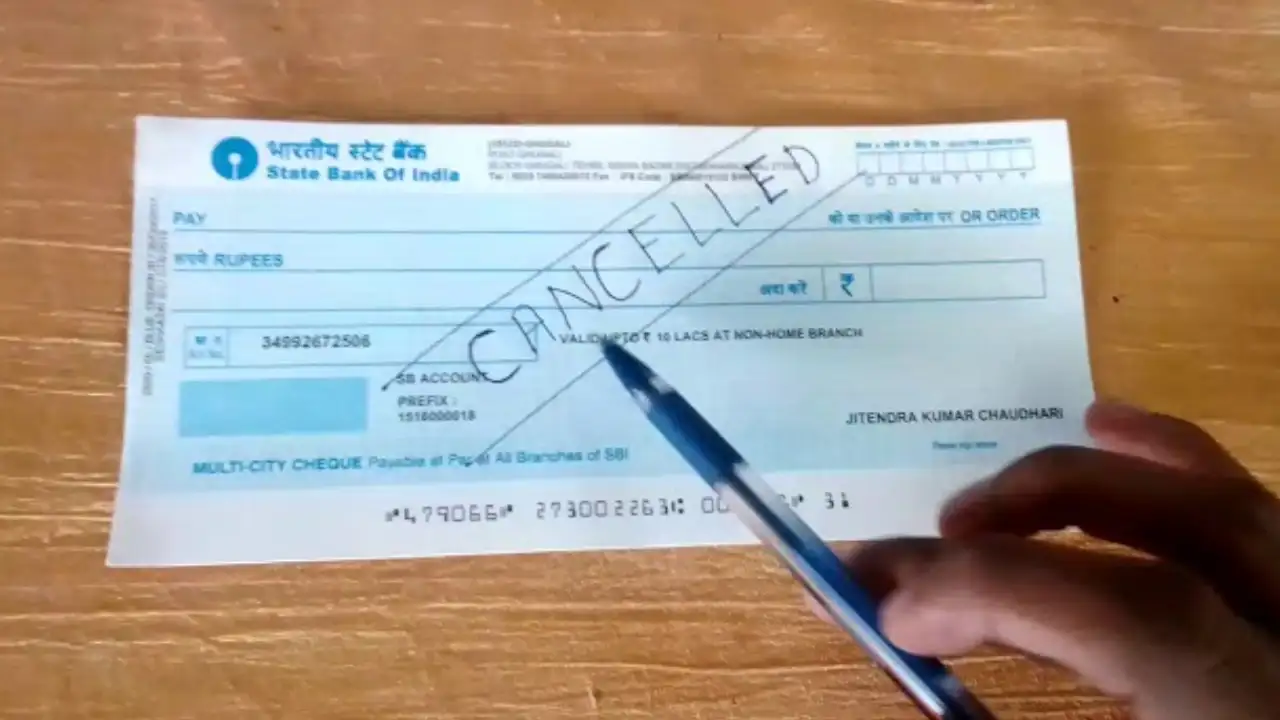

In the modern banking landscape, the cheque remains a vital instrument for both personal and commercial transactions. Despite the rise of digital payments, many individuals and businesses continue to utilise cheques for significant financial dealings. However, it is imperative to acknowledge that a cheque is a sensitive document; even minor errors can result in complications, including the unfortunate scenario of a cheque bouncing.

The implications of a bounced cheque are far-reaching. Not only does it adversely affect the reputation of the issuer, but it may also lead to potential legal consequences. Therefore, it is essential for individuals to exercise diligence when filling out a cheque. Common mistakes include incorrect dates, misspelled names, or insufficient funds in the account.

To mitigate the risks associated with cheque payments, one must adhere to a few fundamental guidelines:

- Double-Check Details: Ensure that all written information is accurate and legible. This includes the payee’s name, amount in both numerical and written forms, and the date.

- Maintain Sufficient Funds: Before issuing a cheque, confirm that adequate funds are available in your account to cover the payment.

- Use Permanent Ink: To prevent alterations, always use a permanent ink pen when writing cheques.

- Record Transactions: Maintain a record of issued cheques in your financial documents to track payments and avoid overdrafts.

- Stay Informed on Expiry: Cheques typically have an expiration period. Ensure that the cheque is presented for payment within the stipulated timeframe.In conclusion, while the use of cheques may seem straightforward, it demands careful attention to detail to prevent financial missteps. By following these guidelines, individuals can navigate the cheque-writing process with greater confidence and security.

Follow DelhiBreakings on Google News

Superfast News Coverage by DelhiBreakings.com team.

For Superfast national news and Delhi Breaking Stories visit us daily at https://delhibreakings.com